Stringent Regulation and Policy Targets

Australia’s federal and state governments have introduced ambitious plans to reshape the waste management sector. One of the most significant is the National Waste Policy Action Plan, which sets a national goal to recover 80% of all waste resources by 2030. These targets are already reshaping how waste is managed across the country, and have led to increased investment in infrastructure, innovation, and supplier capability.

Surge in Onshore Processing

In response to export bans on unprocessed recyclable materials (including paper, plastic, and tires), Australian waste companies have been required to shift processing efforts back onshore. This has driven the construction of new recycling and resource recovery facilities, particularly in major metropolitan areas. According to industry analysts, this trend is supporting local job creation and accelerating the development of advanced waste treatment technologies.

Embracing Technological Advancements

Technology is playing an increasingly important role in transforming the waste sector. Automated sorting lines, AI-powered recycling systems, and smart collection devices are being rapidly adopted. Facilities like Rino Recycling’s plant in Queensland and the Sunshine Coast’s Material Recovery Facility are often cited as leading examples of how technology is being used to improve efficiency and recovery rates.

Circular Economy and Sustainability Focus

Government bodies and private operators alike are shifting toward a circular economy model. This model emphasizes resource recovery, recycling, and reduced reliance on landfill disposal. According to the Australian Circular Economy Hub (ACEH), this shift is being driven by both regulatory incentives and increasing public demand for sustainable environmental practices.

Specialized Waste Solutions

Market analysts have observed growing specialization in waste management services. Companies are increasingly offering tailored solutions for municipal waste, e-waste, medical waste, and construction and demolition debris. This specialization allows operators to better navigate complex environmental regulations and achieve higher compliance rates in line with sustainability targets.https://aresbins.com/

Market Drivers

Annual Waste Volume

Australia generates over 75 million tonnes of waste annually (according to the 2020 National Waste Report). This continues to place significant pressure on existing systems and creates strong demand for high-capacity, scalable, and durable waste-handling equipment.

Population Growth

As of December 2023, Australia’s population reached approximately 26.97 million, with continued growth forecasted. This increases household, industrial, and commercial waste output, requiring stronger waste collection and processing infrastructure.

Upgraded Infrastructure Needed

With urban populations growing and more people living in high-density areas, localized waste volumes are increasing. According to infrastructure planning agencies, there is an urgent need for smarter bin systems, more efficient collection logistics, and upgraded sorting technology to meet demand and comply with updated environmental standards.

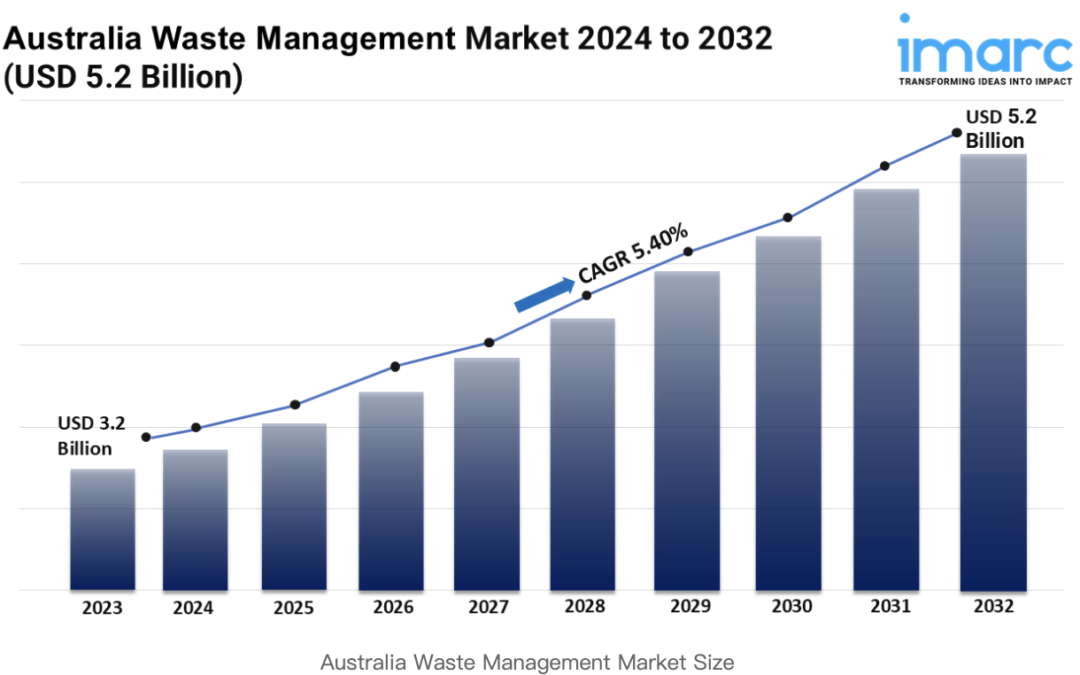

Outlook

The Australian waste management industry is evolving rapidly in response to regulatory pressure, environmental responsibility, and technological disruption. As competition intensifies, waste service providers are actively seeking reliable suppliers and partners who can support innovation, ensure compliance, and provide scalable equipment solutions. These conditions are creating growing demand for high-quality, customized waste equipment, particularly from manufacturers that understand the local market and can deliver consistently.

Recent Comments