1.Market snapshot: big volume, thin margins

On paper, the Australian skip bin market looks attractive:

-

The skip bin rental industry is worth around AU$2.6 billion and has been growing slowly over recent years.

-

Australia generates over 75 million tonnes of waste each year, with construction & demolition (C&D) waste alone exceeding 26 million tonnes – much of it handled through skips and hooklift bins.

So demand is not the problem.

The real issue is that revenue growth is low, costs keep rising, and competition is intense. That’s why many small and mid-sized skip bin operators feel busier than ever, but profit per job is shrinking.

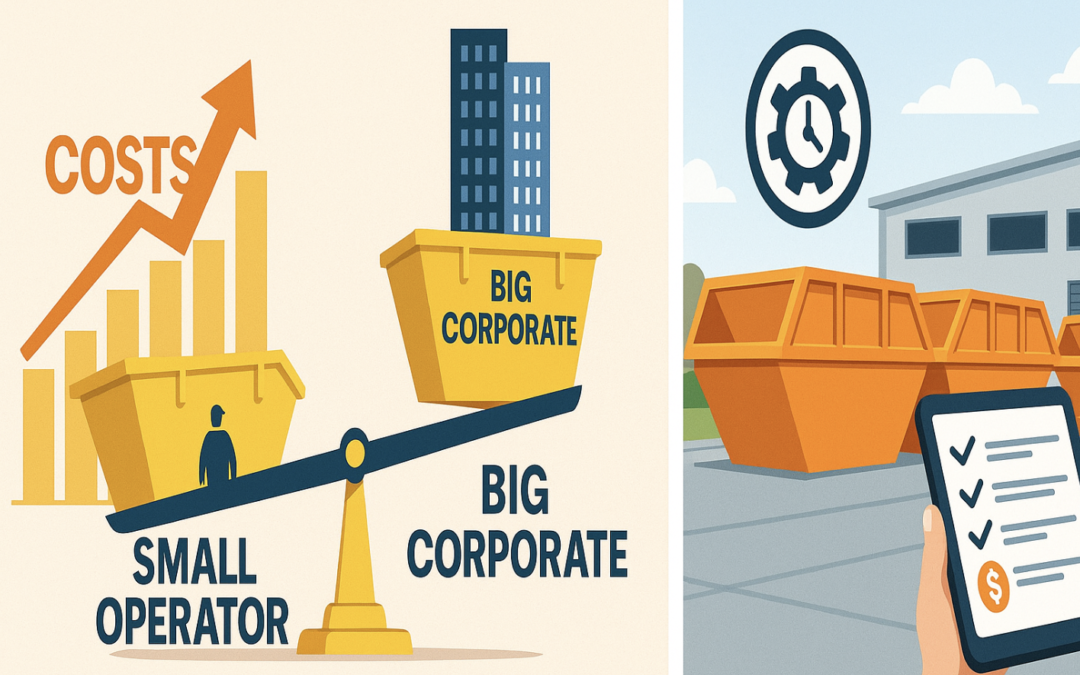

2. Why small skip bin companies are under pressure

Reason 1 – Costs rise faster than prices

Disposal and operating costs have been climbing for years:

-

Landfill and transfer station fees (tip fees)

-

Landfill levies and environmental charges

-

Fuel, tyres, truck maintenance, insurance and wages

Industry reports note that profit margins have been squeezed even when revenue grows, because disposal and labour are taking a bigger share of each dollar.

In a crowded local market, most operators can’t simply increase prices 1:1 with costs, or they risk losing jobs. The result: more work, similar turnover, less profit per load.

Reason 2 – Price transparency turns bins into a commodity

New online platforms and comparison sites list multiple skip bin companies side by side, with:

-

Size

-

Number of days included

-

Price as the main decision factor

Nationwide price-comparison sites actively promote “find the best price on skip bins”, which pushes customers to treat every bin as the same product and simply pick the cheapest.

At the same time, data shows revenue per employee has declined, meaning operators must complete more jobs to generate the same income.

Reason 3 – Stricter regulations add compliance cost

Australia is pushing hard on landfill diversion and resource recovery:

-

National strategies aim to increase recycling and reduce the amount of waste going to landfill, especially C&D waste.

-

States are tightening controls on contaminated soils, asbestos, mixed construction waste and illegal dumping.

For skip bin companies, this means:

-

More sorting and more separate waste streams

-

More rules and documentation

-

Higher standards for depots, transport and disposal

All of this costs time and money. Large firms spread this across big volumes and integrated facilities. Smaller operators often carry the cost but struggle to fully recover it in their prices.

Reason 4 – Large integrated players control key parts of the chain

The Australian waste industry has moderate concentration, with big companies (for example, integrated waste majors) holding significant market share.

These groups often:

-

Own or control transfer stations, MRFs and landfills

-

Run large fleets of skip, hooklift and frontlift trucks

-

Sign bundled multi-year contracts with councils, builders and commercial clients

Small operators then face a double squeeze:

-

They pay “retail” disposal prices at facilities often owned by the big players

-

They compete against those same players for customers, but without the same tipping rates, brand recognition or contract scale

In other words, the middle of the value chain is getting thinner.

3. What successful skip bin operators do differently

The good news: some small and mid-sized companies are still growing and profitable. They are doing a few things consistently well:

-

They don’t compete only on price

-

They specialise in certain segments:

-

C&D-heavy projects

-

Contaminated waste / asbestos (with proper compliance)

-

Long-term commercial frontlift / hooklift contracts

-

-

They sell reliability, compliance and service – not just “cheap bins”.

-

-

They know their true cost per job and per bin

-

Every truck run has a target utilisation (tonnes or m³ per trip).

-

Every bin has a planned lifecycle (years in service, repairs, repaints).

-

They track which customers, suburbs and waste streams actually make money.

-

-

They standardise and upgrade their equipment

-

Fewer bin types, but smarter sizes that cover most jobs

-

Stackable / nestable designs to reduce transport and storage costs

-

Heavy-duty floors, reinforced corners and better coatings to extend bin life

-

-

They use basic digital tools

-

Simple routing / job management software to reduce empty runs

-

Online booking and clear loading rules to avoid disputes and rework

-

Numbered or QR-coded bins so they always know where each asset is

-

4. How better skip bins help protect margins

In a low-margin AU$2.6bn market, your bins are not just a cost – they are your core asset.

Well-designed bins can:

-

Last longer before needing repair or repaint

-

Load and unload faster, reducing turnaround times

-

Stack more efficiently in your yard and in shipping containers

-

Handle heavier or more abrasive waste streams without constant welding

For manufacturers like Aresbins, this is exactly where we focus:

-

Heavy-duty steel selection (e.g. thicker floors for C&D, reinforced top rails)

-

Standardised Australian-style geometry for marrel, hooklift and frontlift bins

-

Stacking-friendly designs to maximise container loads and yard space

-

Optional wear plates and upgraded coatings for harsher environments

The goal is simple:

Every skip, hooklift or frontlift bin should pay for itself many times over its life – not just survive the warranty period.

5. Why Aresbins is a good fit for small and mid-size operators

In a market where costs keep rising and margins are thin, the quality and cost of every bin really matter. This is where Aresbins comes in.

Aresbins is a China-based manufacturer focused on Australian-style skip, hooklift and frontlift bins.

By manufacturing in China – one of the world’s largest export hubs – and using automated cutting and welding, we can usually offer a lower total cost per bin than local manufacturing, while still meeting Australian geometry and durability expectations.

For small and mid-size skip bin companies, this means:

-

More value from each dollar invested in bins – heavy-duty floors, stronger corners and better coatings at an export-competitive price.

-

Standardised, stackable designs that maximise container loads and yard space, helping reduce freight and storage costs.

-

Flexible configurations (sizes, thickness, doors, crane eyes, HDG, colours and branding) to match your local customer mix.

Instead of competing only on price, you can use better, longer-lasting bins to improve service, protect your margins and grow in the AU$2.6bn skip bin market.

If you’d like to explore how Aresbins can help upgrade your fleet or optimise a container load for your region, reach out to our team for a detailed specification and quotation.

Recent Comments